Old Home Buying Advice That No Longer Works | Oakville & Burlington

Old Home Buying Advice That No Longer Works (And What Buyers Should Do Instead)

Buying a home today feels harder than it used to — not because good homes don’t exist, but because much of the advice buyers are following no longer matches the reality of today’s market.

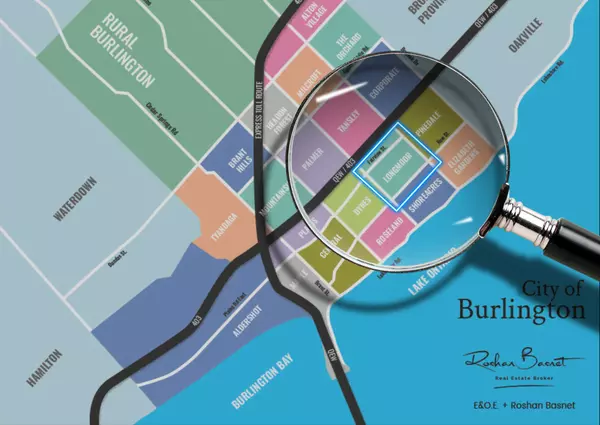

I see this every week working with buyers across Oakville, Burlington, and the Greater Toronto Area.

Well-intentioned advice from years ago is now causing buyers to:

-

Miss homes that actually fit their lifestyle

-

Over-negotiate and lose deals

-

Compromise on location or livability

-

Regret purchases just a few years later

In this guide, I’ll break down outdated buyer strategies that no longer work — and what smart buyers are doing instead.

🎥 Watch the full video version here:

Why Old Buying Advice Is Costing Buyers Today

The market didn’t “break.”

Buyer strategies did.

Advice that worked in 2018 — or even during the 2020–2021 frenzy — doesn’t line up with today’s environment. Buyers are stuck between waiting for the perfect time and not wanting to make a mistake.

The result? Paralysis.

Let’s fix that.

1. Waiting for the “Perfect” Market

Many buyers are still waiting for:

-

Interest rates to drop further

-

Prices to fall across the board

-

Clear headlines saying “now is the time to buy”

The problem? Markets don’t move in straight lines anymore.

They move in bursts.

I’ve seen buyers pause early in the year, still “watching” months later, only to realize they’re priced out of the very neighbourhoods they could have bought in earlier.

Waiting didn’t protect them. It leapfrogged them.

What smart buyers do instead

They buy when:

-

The numbers make sense for their situation

-

The home fits their lifestyle

-

The long-term picture works

They don’t time headlines — they time fit.

2. Trusting Automated Home Values

Online estimates can be helpful for quick research, but they are not market value.

Algorithms don’t:

-

Walk through homes

-

Hear highway or rail noise

-

Smell industrial areas in summer

-

Judge layout functionality or renovation quality

Two homes on the same street can differ by over $100,000 — and that difference is invisible to an algorithm.

What smart buyers do instead

They focus on:

-

Street-level comparables

-

Condition and layout

-

Buyer demand for that specific pocket

Local context always beats generic data.

3. Thinking You Can Outwait Competition

Many buyers believe that if they pass on a home they like, a better one will come along.

Here’s what actually happens.

They find a house where:

-

The layout works

-

The location fits their lifestyle

-

Most boxes are checked

But they hesitate.

The house sells.

Six months later, they’re still looking — not because they want to be, but because the right home is gone. And it’s usually the one they compare every other house to.

The bigger reality: sellers are waiting too

Sellers with good homes — upgraded, well-located, move-in ready — won’t list if they know they won’t get fair value.

So buyers wait.

Sellers wait.

That creates a stalemate — fewer good homes, not more.

4. Skipping Pre-Approval Until You “Find the One”

This is one of the most misunderstood mistakes buyers make.

Even a short financing condition can create doubt in a seller’s mind:

-

Will this deal fall apart?

-

Is the buyer actually qualified?

Why pre-approval creates leverage

When a strong pre-approval is in place, I can confidently tell the seller:

“Financing is a formality. The lender just needs to qualify the property and confirm valuation.”

That removes fear.

And when sellers feel confident in a buyer, they are often more flexible on price.

Certainty doesn’t just win offers — it saves money.

5. Lowballing Because It Used to Work

Lowballing worked in past markets.

The way buyers try to do it today often backfires.

Here’s why.

Sellers are listening to their agents too. Most understand that peak prices from 2022 are gone — but that doesn’t mean they’re desperate.

Some sellers:

-

Have built their entire net worth in their home

-

Are already cutting six-figure losses

-

Are selling out of necessity, not greed

When buyers come in aggressively low without logic, they signal:

“We’re bargain hunters, not serious negotiators.”

That’s when sellers shut down — or counter right back at full price.

Negotiation isn’t about winning the discount. It’s about winning the house.

6. Believing Every Home Will Get Cheaper

Waiting feels safe.

But time alone doesn’t fix affordability.

We still have:

-

Supply constraints

-

Population growth

-

Rising replacement and construction costs

Some markets don’t crash.

They pause — and then move again.

I’ve seen buyers wait through an entire slowdown only to realize prices never returned to where they started.

Smart buyers think in years, not seasons.

7. Chasing the Cheapest Listing

Buying the cheapest house just to “get in” is outdated advice.

Cheap usually stays cheap for a reason:

-

Traffic

-

Noise

-

Zoning issues

-

Compromised location

Here’s advice I give my buyers often:

If you can responsibly afford it, buy the best house you can at the top of your budget.

Pulling back even 5% may mean:

-

One-car garage instead of two

-

Under 2,000 sq ft instead of 2,400

-

A home you grow out of instead of into

When the market improves, those better homes don’t get cheaper — they move out of reach.

That’s where regret shows up.

8. Ignoring Commute Reality

Many buyers say:

“It’s fine — I only go into the office once or twice a week.”

That may be true today.

What changes isn’t the job — it’s tolerance.

Over time:

-

Work expectations shift

-

Life gets busier

-

Commutes feel heavier

I’ve seen buyers love their house and still want to move because the daily grind wore them down.

You can renovate a house.

You can’t renovate a commute.

A Real-World Planning Caution: Midtown Oakville

Buyers also need to think about what’s coming, not just what exists today.

In Midtown Oakville, major high-density development has been proposed near the GO station — including multiple high-rise towers.

Whether someone supports that plan or not isn’t the point.

The point is this: the home you buy today may sit in a very different environment ten years from now.

Growth changes neighbourhoods — traffic, density, noise, and lifestyle.

Smart buyers don’t just buy a house.

They buy into the future of the area.

The Golden Advice: Buy the Right House

Here’s the advice that saves buyers the most regret:

Buy when you find the right house.

The wrong house looks good — but lives badly.

-

The layout doesn’t work

-

The space feels just a bit too small

-

The noise never stops

-

You already feel like you’ll move again

The right house is the one you move into and think:

“I can see myself here for ten years.”

That’s when buying makes sense.

Not because of the market —

but because the home truly fits your life.

Thinking of Buying or Selling?

Whether you’re buying or selling in 60 days or six months, clarity matters more than timing.

I offer a free, no-obligation, one-on-one consultation to walk through your situation properly — no pressure, no sales pitch, just strategy.

👉 Book your consultation using the link below.

And if you haven’t already, watch the full video embedded above for deeper insight.

Roshan Basnet is a local real estate broker specializing in Oakville and Burlington, helping buyers and sellers make informed, long-term decisions in changing market conditions.

Categories

Recent Posts

Work with me and “Keep What’s Yours! ®” a proven business model that saves home buyers and sellers thousands in real estate commissions.

4145 North Service Rd Unit: Q 2nd Floor L7L 6A3, Burlington, ON, Canada