Property Tax in Burlington, Ontario: Everything You Need to Know

Understanding Property Taxes in Burlington, Ontario: A Complete Guide for Homeowners

If you're a homeowner in Burlington, Ontario, or considering buying a property here, understanding property taxes is crucial. Property taxes are an essential part of homeownership, covering the costs of local services like road maintenance, education, emergency services, and more. This guide will provide a clear overview of how property taxes work in Burlington, helping current and future homeowners navigate the process with confidence.

To find out your property tax estimates in Halton Region click here

1. What Are Property Taxes in Burlington, ON and How Are They Calculated?

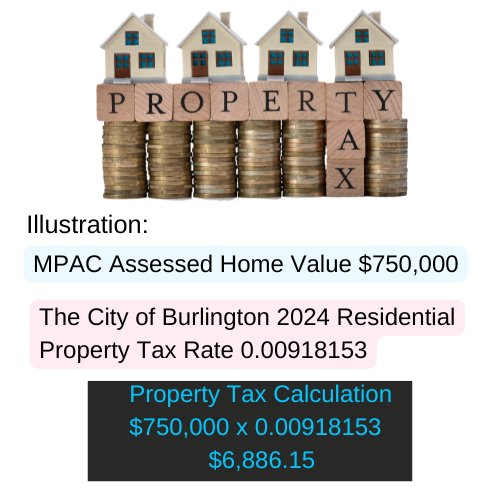

Property taxes in Burlington, like elsewhere in Ontario, are calculated based on the assessed value of your property. The Municipal Property Assessment Corporation (MPAC) is responsible for determining the current value of all properties in the province. MPAC assesses properties every four years, considering factors such as:

- Location: The neighbourhood or area where your property is located.

- Size and Lot Dimensions: The square footage of the house and the lot size.

- Age and Condition: The age of the property and any renovations or upgrades.

- Comparable Sales: Recent sales of similar properties in the area.

Once the assessed value is determined, Burlington applies a municipal tax rate to this value. This rate is set annually by the City of Burlington and the Halton Region, reflecting the budgetary needs of the local government and the region. Property taxes are a combination of the municipal rate and the education rate (set by the provincial government to fund public education).

Want to know how your home's assessed value is determined? Go to About My Property

If you still disagree with MPAC’s assessment or classification of your property, you can choose to either file a Request for Reconsideration (RfR) with MPAC or file an appeal directly with the Assessment Review Board (ARB).

According to MPAC: "Due to the COVID-19 pandemic, the Ontario government has postponed the 2020 Assessment Update. On August 16, 2023, the Ontario government filed a regulation to amend the Assessment Act, extending the postponement of a province-wide reassessment through the end of the 2021-2024 assessment cycle. Property assessments for the 2023 and 2024 property tax years will continue to be based on fully phased-in January 1, 2016 current values."

If you are a first-time home buyer visit First-time Homeowners’ Hub

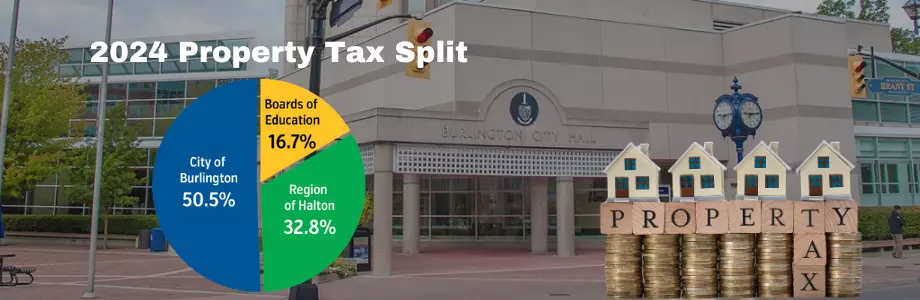

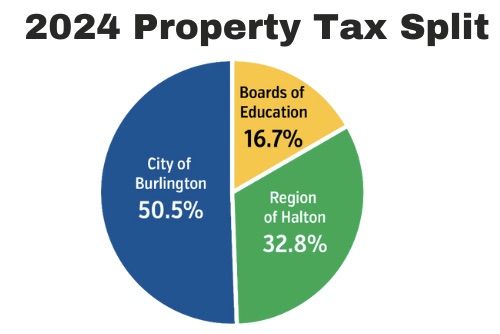

2. The Components of Property Taxes in Burlington

Property taxes in Burlington are composed of three primary components:

- Municipal Taxes: Fund local services such as road maintenance, snow removal, parks, libraries, and public transit. This portion is set by the City of Burlington.

- Regional Taxes: Fund services provided by the Halton Region, including waste management, social services, health services, and regional roads.

- Education Taxes: Fund public schools and are set by the provincial government.

Each year, Burlington’s City Council and Halton Region Council review their budgets to determine the municipal and regional tax rates. The Ontario Ministry of Finance determines the education tax rate. The combined rate is then multiplied by the assessed value of your property to calculate your total property tax bill.

Check out the City of Burlington Tax Split click here

3. Understanding Your Property Tax Bill

Your property tax bill in Burlington is typically issued twice a year, with interim and final installments:

- Interim Bill: Sent early in the year, usually covering about 50% of the previous year's total property tax amount. This bill helps the city manage its cash flow early in the year.

- Final Bill: Sent later in the year, it reflects any changes in the tax rate or property assessment. It covers the remaining amount owed for the year.

These bills will clearly indicate the amount payable and the due dates. Property taxes can be paid in several ways, including online banking, pre-authorized payment plans, in-person at City Hall, or by mail.

4. Property Tax Relief Programs and Rebates

Burlington offers several property tax relief programs and rebates to support specific groups of homeowners:

- Senior Homeowners: Seniors may qualify for a deferral program that allows them to defer payment of a portion of their property taxes until the home is sold or ownership changes.

- Low-Income Homeowners: A deferral program is also available for low-income property owners to ease the burden of property tax payments.

- Charitable Organizations and Vacant Commercial/Industrial Property: These entities may be eligible for partial rebates.

These programs are designed to help alleviate the financial burden for qualifying property owners. Eligibility criteria and application deadlines vary, so it’s important to check with the City of Burlington for the most up-to-date information.

For The City of Burlington Rebates and Deferrals click here

5. Tips for Managing Your Property Taxes

- Stay Informed: Keep up with any changes in municipal, regional, or education tax rates, as they can fluctuate based on government budgets.

- Appeal Your Assessment: If you believe your property has been over-assessed by MPAC, you have the right to file a Request for Reconsideration (RfR) to potentially lower your assessed value and, consequently, your tax bill.

- Take Advantage of Payment Options: Consider enrolling in pre-authorized payment plans to spread your tax payments over several months rather than paying in lump sums.

6. The Impact of Property Taxes on Buying or Selling a Home

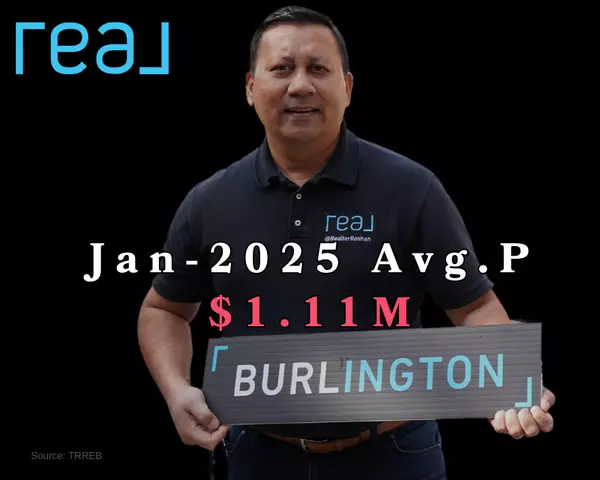

For home buyers, understanding property taxes is essential to budgeting effectively. When buying a home in Burlington, consider the annual property tax costs as part of your overall expenses. For sellers, an accurate understanding of property taxes can help in pricing the home appropriately and explaining tax costs to potential buyers.

For Professional Real Estate Broker consultation, contact your local Burlington Market expert Roshan Basnet

7. Conclusion: Staying Informed and Proactive

Property taxes in Burlington, ON, are a necessary aspect of homeownership, supporting essential community services and infrastructure. By understanding how they are calculated, what they fund, and how to manage them effectively, you can navigate the process with ease. Staying informed about local tax rates, taking advantage of available relief programs, and ensuring your property assessment is accurate can help you manage these costs confidently.

If you have more questions or need further assistance understanding property taxes or any other aspect of the real estate market, feel free to reach out to me. As your trusted local real estate expert, I’m here to help guide you through every step of your homeownership journey in Burlington.

Wondering how your City of Burlington Property Taxes are used? Click Here

Roshan Basnet is a seasoned real estate broker with extensive experience in the Oakville and Burlington markets. Known for his personalized approach and deep market knowledge, Roshan is dedicated to helping clients make informed decisions and achieve their real estate goals. Whether buying or selling, working with Roshan means partnering with a trusted expert who ensures a smooth and successful real estate journey.

Categories

Recent Posts

Work with me and “Keep What’s Yours! ®” a proven business model that saves home buyers and sellers thousands in real estate commissions.

4145 North Service Rd Unit: Q 2nd Floor L7L 6A3, Burlington, ON, Canada