12 First-Time Homebuyer Mistakes to Avoid in Canada

Buying your first home in Canada is one of the most exciting milestones of your life, I bought my first home in 2003 but it can also feel overwhelming if you're not prepared.

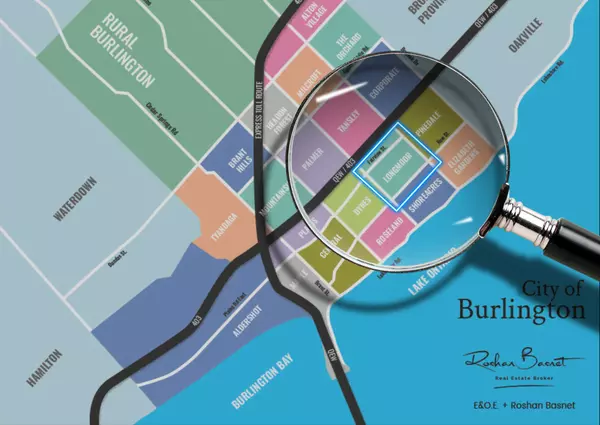

I'm Roshan Basnet, a real estate broker specializing in Burlington and Oakville, and today, I’m here to share the 12 most common mistakes first-time homebuyers make—and how you can avoid them.

1. Not Accounting for Closing Costs

Many first-time buyers focus solely on the purchase price and forget about the closing costs, which can add up to 1.5% to 4% of the home’s value. Think land transfer tax, legal fees, title insurance, and even moving costs. Make sure you budget for these expenses upfront to avoid surprises.

2. Not Checking Your Credit History Before Applying for a Mortgage

A strong credit history is critical for getting approved for a mortgage with the best possible rate. Check your credit score early, correct any errors, and avoid major purchases before your mortgage application. No new car loans. No installment TV or Furniture purchases.

3. Falling in Love with the House Instead of the Area

It’s easy to fall in love with a beautiful kitchen or a renovated bathroom, but remember—you’re not just buying the house; you’re buying into the neighborhood.

Research local amenities, commute times, schools, and the overall vibe of the area before making an offer.

If you buy the worst house in the best street, you are all set. If you buy over improved house in the worst area, your home value will stagnant.

4. Not Getting Pre-Approved for a Mortgage

Shopping without pre-approval is like walking into a store without knowing your budget. It is really pretty much window shopping.

Pre-approval helps you understand what you can afford and makes you a more serious buyer in the eyes of sellers.

In a competition, you can submit your offer with a copy of pre-approval and Seller will strongly consider your offer.

5. Buying More Than You Should

Just because the bank pre-approves you for a certain amount doesn’t mean you should max out your budget.

Keep some breathing room for unexpected expenses like rising interest rates, property taxes, or repairs.

Don’t jepordize your lifestyle and become house rich and cash poor.

6. Buying the Wrong House

Don’t let cosmetic upgrades or trendy designs distract you from what truly matters—space, functionality, and long-term needs.

Think about your lifestyle five or ten years down the line before committing.

W You can always change the Kitchen appliances or renovate the bathroom, try adding square footage and that’s a costly gig.

7. Skipping the Home Inspection

In competitive markets, some buyers skip the home inspection to close the deal faster. But this can be a costly mistake if hidden issues like mold, foundation problems, or outdated wiring come up later.

The cost of home inspection can range $350-$500 This is a fraction of money when you compare it to the price of home.

If you skip a home inspection and you go to the court, the obvious question a judge is going to ask you is “Did you do an inspection?” If not, then you took all the risk.

If there is an offer date, ask your agent if you can do an inspection before putting an offer. If you find issues, that $500 saved you from paying a lot to beat out the competition.

8. Ignoring Government Programs for First-Time Buyers

Canada offers great incentives for first-time buyers, like the First-Time Home Buyer Incentive, RRSP Home Buyers’ Plan, and Land Transfer Tax Rebates.

Not exploring these options could mean missing out on significant savings. You mortgage broker, lawyer and Real Estate professional all can help you navigate this.

9. Focusing Solely on the Purchase Price

Your monthly budget isn’t just about the mortgage.

Property taxes, utilities, maintenance, and insurance all add up. Be realistic about what you can afford in the long run. And then you have your lifestyle costs to account for.

10. Being Unprepared for Bidding Wars

In hot markets, it’s easy to let emotions take over during a bidding war.

Have a maximum budget in mind and stick to it, or you could overpay and regret it later.

Do not get emotional and get carried away. Stick to your maximum budget. Walk away when you feel like bidding is getting out of control.

11. Not Understanding the Importance of Resale Value

Even if this is your forever home, life happens. Choose a property with good resale value—look at location, layout, and market trends to ensure it holds its value.

If the house is overimproved for your area, do not put huge premium for it. The location value dictates home values. For Resale, if you have the best house on the street does not mean all buyers see it that way to pay you huge premium for it.

12. Underestimating the Costs of Homeownership

Owning a home is more than just paying the mortgage.

Repairs, upgrades, and landscaping can quickly add up. Set aside an emergency fund to cover these unexpected costs.

Final Thoughts

Buying your first home doesn’t have to be overwhelming if you know what to look out for. By avoiding these common mistakes, you’ll be well on your way to a smooth and successful purchase.

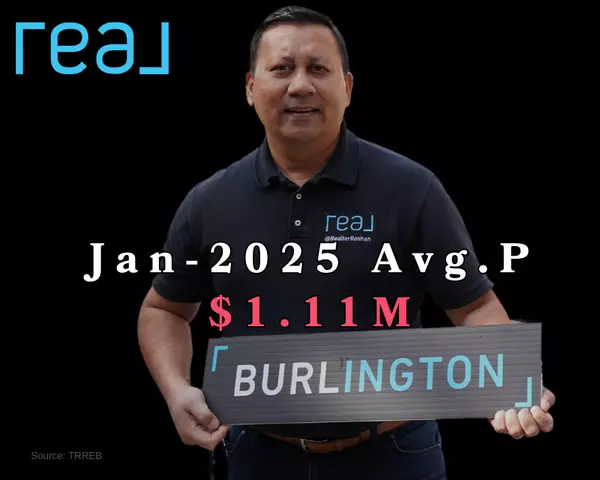

If you’re thinking of buying in Burlington, Oakville, or the surrounding areas, let’s chat—I’d love to guide you through the process.

Roshan Basnet is a seasoned real estate broker with extensive experience in the Oakville and Burlington markets. Known for his personalized approach and deep market knowledge, Roshan is dedicated to helping clients make informed decisions and achieve their real estate goals. Whether buying or selling, working with Roshan means partnering with a trusted expert who ensures a smooth and successful real estate journey.

Categories

Recent Posts

Work with me and “Keep What’s Yours! ®” a proven business model that saves home buyers and sellers thousands in real estate commissions.

4145 North Service Rd Unit: Q 2nd Floor L7L 6A3, Burlington, ON, Canada