7 Essential Tips to Get Approved for a Mortgage in Today's Market

7 Essential Tips to Get Approved for a Mortgage in Today's Market

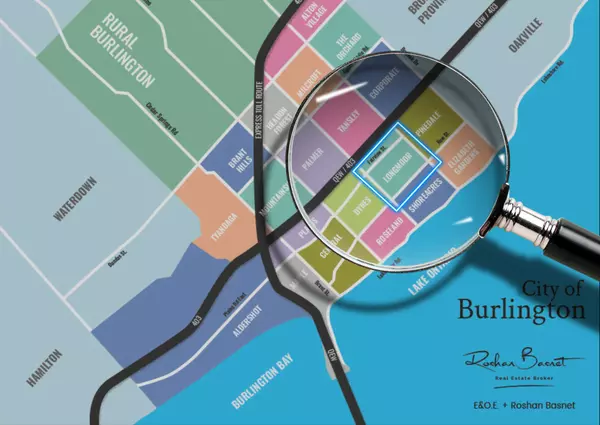

Buying a home is a major financial commitment, and getting approved for a mortgage is a crucial first step. As a realtor with deep experience in the Oakville and Burlington markets, I've seen what it takes to secure mortgage approval.

Here are Seven Essential Tips to help you navigate the process confidently.

1. Check and Improve Your Credit Score:

Lenders rely heavily on your credit score to assess risk. Review your credit report, correct any errors, and work on improving your score by paying off debts and avoiding new ones. Your credit score is a snapshot of your overall financial health, so it’s important that you know what yours is.

In Canada, credit scores run from 300 to 900 across five categories: Poor, Fair, Good, Very Good and Excellent. Ideally, you want your score to be at least 660, but higher is always better.

2. Save for a Larger Down Payment:

A substantial down payment not only reduces your mortgage amount but also makes you a more attractive borrower. Aim for at least 20% to avoid CMHC insurance and secure better rates.

What’s the minimum down payment for mortgage approval?

In Canada, there are minimum down payment requirements based on the home’s price:

- Less than $500,000: The minimum down payment is 5% of the purchase price.

- $500,000 to $999,999: You’ll need 5% of the first $500,000 and 10% for the portion of the purchase price above $500,000.

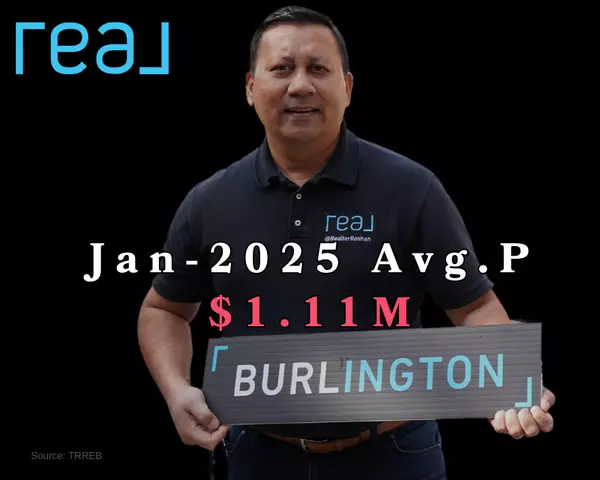

- $1 million+: 20% of the total purchase price at minimum.

In Canada, a down payment of less than 20% of the home’s purchase price requires the buyer to buy mortgage loan insurance. Paying these insurance premiums will increase your monthly mortgage payment.

3. Maintain Stable Employment and Income:

Lenders prefer consistent income. If you're considering a job change, waiting until after your mortgage approval is ideal.

Having a full-time job is a strong indicator of stable, long-term income, which is attractive to lenders. A longer tenure with your current employer further strengthens your application, although other factors are also considered. If you’re applying with a partner, both having full-time employment provides an even stronger financial profile.

If you're self-employed, securing a mortgage can be more challenging. You'll need to provide comprehensive documentation of your business and income over several years to prove your financial stability and ability to meet mortgage payments. To improve your chances, consider consulting with a licensed mortgage broker who can help you prepare a strong application by leveraging their expertise and understanding of the mortgage market.

4. Pay Down Existing Debts:

Lowering your debt-to-income ratio by paying down debts can improve your mortgage eligibility. Focus on clearing high-interest debts first.

5. Get a Mortgage Pre-Approval:

A pre-approval shows sellers you’re a serious buyer and gives you a clear understanding of your borrowing capacity. It also locks in an interest rate for a specified period.

A mortgage pre-approval is when a lender reviews your financial details and approves you for a specific mortgage amount, interest rate, and term. This pre-approval is typically valid for 90 to 120 days, depending on the lender, allowing you time to find a home while securing a favourable mortgage rate.

6. Shop Around for the Best Mortgage Rate:

Don’t settle for the first mortgage offer. Compare rates from multiple lenders, including banks, credit unions, and mortgage brokers, to ensure you get the best deal.

To Speak to an Experienced Mortgage Broker contact Ming Wong.

7. Understand Your Affordability Limits:

Know how much house you can afford based on your income, debt, and down payment. This knowledge helps avoid disappointment and narrows down your home search to suitable properties.

You should also factor in other purchasing costs, like home inspections and closing costs (usually about 3-4% of the purchase price).

As a seasoned realtor in the Oakville and Burlington areas, I’m here to guide you through every step of your home-buying journey. Let’s work together to make your dream home a reality!

Categories

Recent Posts

Work with me and “Keep What’s Yours! ®” a proven business model that saves home buyers and sellers thousands in real estate commissions.

4145 North Service Rd Unit: Q 2nd Floor L7L 6A3, Burlington, ON, Canada